The current pandemonium in the stock market seems to have come to an end after the weeks of turmoil in early March. Credit Suisse is being bailed out, and first citizens is taking over the failed Silicon Valley Bank. Investors are optimistic because of the fact that the banking turmoil that has dominated the headlines for the past three weeks has quieted down, at least for now.

But the banking industry isn’t out of the woods yet. In fact, the worst may be yet to come. And many of us probably won’t know what’s happening until that thing hits the fan.

And that is because of an obscure rule that allows banks to hide the true extent of their troubles, giving investors a false sense of security.

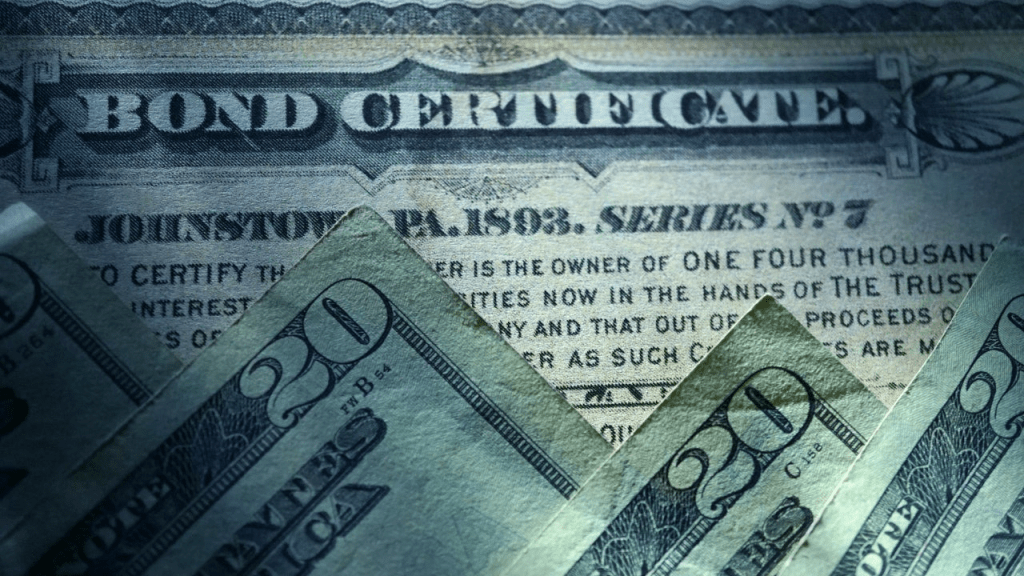

According to current regulations, banks can hold assets as “available for sale”, which requires them to be valued at market prices. However, banks can also classify the held assets as being “held to maturity”, which changes their valuations to the price that these assets were purchased at. This allows banks to hide losses on their assets in order to remain in the good graces of investors.

According to the Wall Street Journal, six major US banks, including PNC, have switched the classifications on $500 billion of their assets. These assets are valued at more than $1.1 trillion, making them $118 billion, or 12% overvalued compared to market prices.

These “held-to-maturity” securities consisted of more than half of the US banking industry’s unrealized losses, even as they consist of slightly less than half of securities held by US banks. Which means that securities “held to maturity” tend to perform much worse than other securities valued at market rates. Furthermore, the portion of assets held by banks under this classification has increased from 34% to 48% over the past year, which means that these 14% of assets have deteriorated significantly enough over the past year to warrant such a move by the banks. This amounts to a total of more than $500 billion in assets, which indicates that the securities market has deteriorated significantly since last year.

The banks argue that they may never have to sell these assets before maturity. However, given reduced confidence in the banking industry due to recent events, which makes a run more likely. If a run happens, banks will have no choice but to sell their assets, and when they do, it will come to light that they lost more money than what was previously known to many investors. And by then, it will be too late to stop what’s to come.

https://www.wsj.com/articles/as-interest-rates-rose-banks-did-a-balance-sheet-switcheroo-8e71336f

Leave a comment