Exxon Mobil is one of the largest giants in the energy market. It’s emphasis on oil and gas production may lead investors to place a low value on its long-term performance as the world begins to be more mindful of the impacts of climate change. However, Exxon seems to be addressing its own climate footprint in a more unique way.

Unlike many energy companies, Exxon has shied away from renewable energies, preferring to focus more on oil and gas. It’s carbon-reducing strategy is more oriented around making its current operations cleaner.

Additionally, it has focused on many less-commonly known sources of clean energy: biofuels and hydrogen energy, as well as carbon capture technology. Exxon estimates that this segment of the low-carbon industry will grow to $6.5 trillion by 2050, which will be equal to the traditional oil and gas business at that time. Sensing this opportunity, Exxon has planned to spend $10 billion over the next five years to transition to lower-carbon activities. In fact, Exxon is confident that its revenues from low-carbon activities will surpass revenues from its traditional oil and gas business by 2033. Which is a rather tall task since in 2022, Exxon generated more than $400 billion in revenue.

However, there may be some truth to Exxon’s projections. As the world begins to confront the effects of climate change, the demand for low-carbon alternatives can be expected to increase dramatically in the years to come. So it’s reasonable to expect Exxon’s earnings to get a boost from its burgeoning low-carbon department that will give Exxon a material increase in earnings in the coming years.

Quantifying Exxon’s Future Prospects

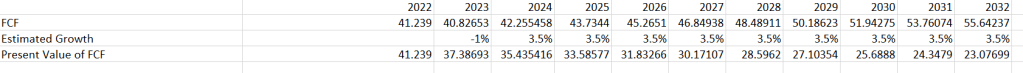

I’ll try to quantify what the future looks like for Exxon’s stock in light of these projections for the low/carbon market. (The numbers below, with the exception of year and growth, are in billions)

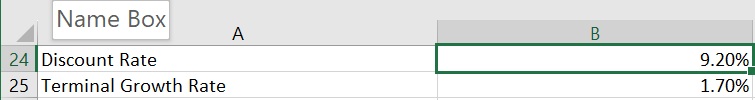

First, I estimated the future cash flows Exxon will bring in over the next 10 years. As a recession looms in 2023, I won’t expect that much growth this year, but as Exxon continues to develop its low-carbon department, I expect the company to reap the rewards for the rest of the coming decade. Therefore, I project the average growth rate of cash flows for 2024-2032 to be well above the average US GDP growth rate of 2.5%. Then, we discount the cash flows by Exxon’s WACC of 9.2%.

For the long term, expect the annualized growth rate to be lower than the GDP growth rate, because if a company grows faster than the economy in the long-term, it will consume the entire US economy, which doesn’t make sense, especially considering the likely decline of the oil and gas industry in the further future.

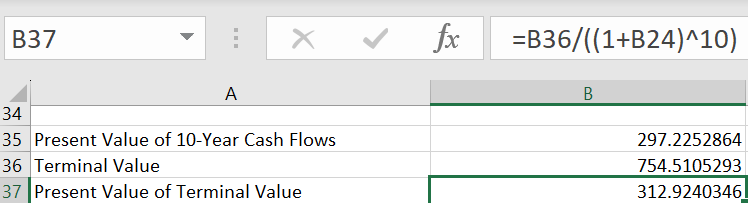

Then, we add up the present value of the current cash flows and the present value of the company’s terminal value, and we divide it by the number of outstanding shares, which amount to more than 4.07 billion. This amounts to a fair value of $148.95, which means that the stock is undervalued at a 21.6% discount.

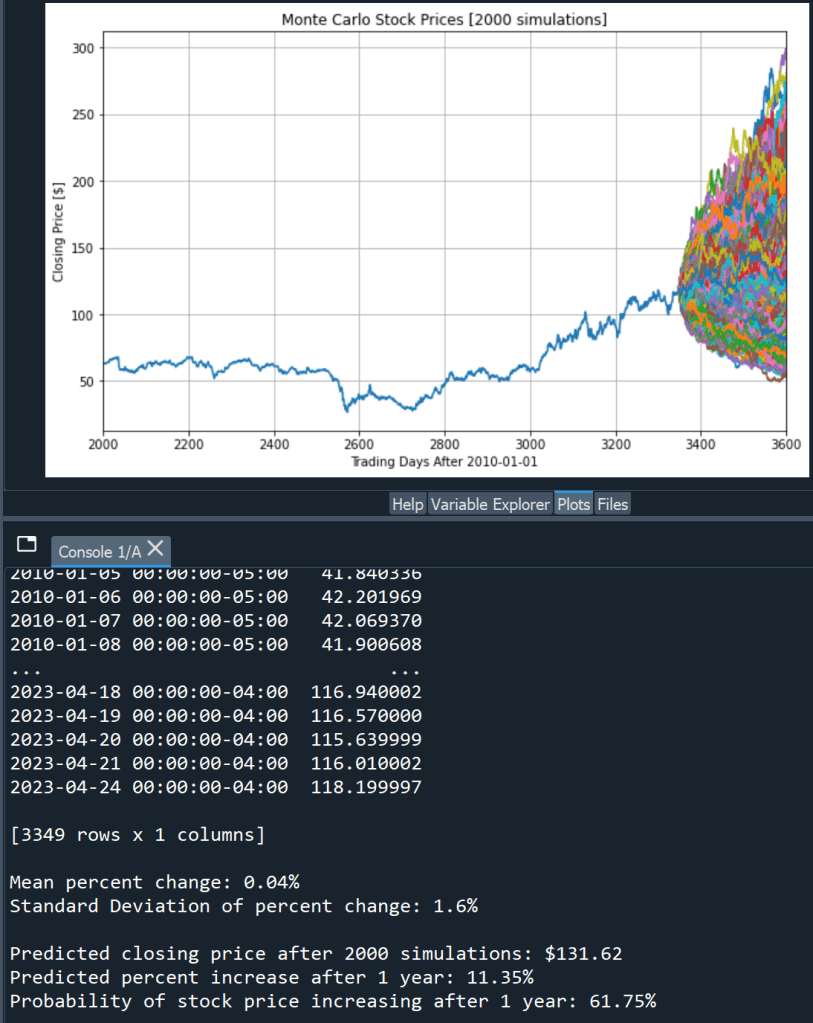

Measuring discounted cash flows is by no means the only credible form of analysis of a company’s stock. Below is an estimate of Exxon’s 1-year growth rate using the Monte Carlo method.

WACC Source: https://valueinvesting.io/XOM/valuation/wacc

Leave a comment