Many observers have noted the relatively muted reaction by investors to the recent debt ceiling standoff. They contend that Wall Street has remained calm thus far and will continue to do so until perhaps a week later.

However, the stock market reaction to today’s inflation report paints a vastly different picture.

Before the inflation data came out, JPMorgan predicted there would be two most likely scenarios for the inflation report: one in which inflation is slightly above expectations (5.0%-5.2%), and one in which inflation is significantly above expectations (5.3%-5.5%).

Then, at 8:30 AM, the inflation report came in: 4.9%.

This was supposed to be a cause for markets to celebrate. And indeed it was, for a while. Markets rallied 200 points in the hour after the report came out.

But just a few minutes after the bell, these gains were wiped out. As of now, what was supposed to be an good day for stocks has turned into a 300-point loss for the Dow, and a drop in the S&P 500.

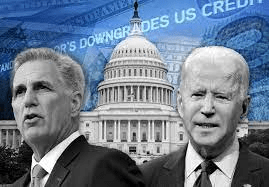

It’s hard to deny the impact that the debt ceiling standoff is having on investors’ minds. And it’s only natural for investors to worry. A default would be catastrophic, with trillions of dollar in investor wealth wiped out and millions of jobs lost, and borrowing costs would skyrocket because of increasing Treasury yields.

However, such standoffs have happened before which ended in last-minute resolutions which managed to allow the US to avoid a default. Furthermore, yesterday’s talks on the debt ceiling did not represent a change in the status quo for the worse. The congressional leaders and the President reiterated their positions, and scheduled staff-level talks. That should actually be a slightly positive development since there is reassurance that the two sides of the debt ceiling debate are robustly communicating with each other. It’s not like Speaker McCarthy stormed out of the meeting half an hour early and said that reaching a deal is unlikely.

With the absence of a breakdown of talks over the debt ceiling, the reason for today’s stock market situation is clear: Wall Street, despite what many observers say, is getting impatient, and markets are pricing in the possibility of a default.

Ironically, Wall Street panic may yet be the crucial catalyst that produces a deal. Financial market jitters have jolted lawmakers into action before. For example, in 2008, when Congress was debating TARP, a stock market meltdown pushed Congress to quickly pass the relief plan with modifications. Former Congressman Joe Crowley famously cited the stock market’s meltdown as a way to get reluctant representatives to support the bailout.

Leave a comment