One of the phenomenons powering this economy to perform above expectations is that the housing market has been exceptionally resilient despite rising mortgage rates.

Home prices have cooled recently after years of surging prices buoyed by ultra-low interest rates and employees moving further away from their jobs as remote work gains prominence. However, after an entire year of aggressive rate hikes, which normally would have devastated housing markets, prices are still on a surprising upward trend.

This phenomenon has left analysts rather stunned as one would expect the increase in mortgage rates that followed the rate hikes to depress demand and lower the price of housing. As of now, the 30-year fixed mortgage rate stands at roughly 7%.

This is in stark contrast to the commercial real estate market. Remote work threatens to wipe out $800 billion in commercial real estate value by 2030, and there are projections that commercial real estate transaction volume will decline by as much as 27% just this year. This continues a trend of rapid decline in the commercial real estate market that has begun in 2021 and has been sustained throughout the past years by aggressive rate hikes.

One reason for this phenomenon is that despite the record prices, less people appear to be selling their homes. In early 2020, there were 928,000 listed homes. In June of this year, there are only 614,000. This decrease in home selling has constrained supply, putting upward pressure on home prices.

This is due to the fact that fixed-mortgage loans are the most popular type of home mortgage for buyers-89% of all mortgages in the United States are fixed. The reason that homeowners are so hesitant to sell is because if they somehow decide to take advantage of their supposedly increasing home prices, when they buy a new home, they would be hit by a mortgage rate double than what they used to pay.

Notice how the peak amount of buying occurred during the time where mortgage rates were the lowest, as we can expect. This buying frenzy likely contributed to an exacerbation of the nation’s housing shortage from 3.8 million in 2019 to 6.5 million as of March 2023. Buyers have gobbled up houses when interest rates were low, and now high mortgage rates are forcing them to hold on to them, and current buyers are coming back after a short hiatus despite high mortgage rates. This is keeping prices up.

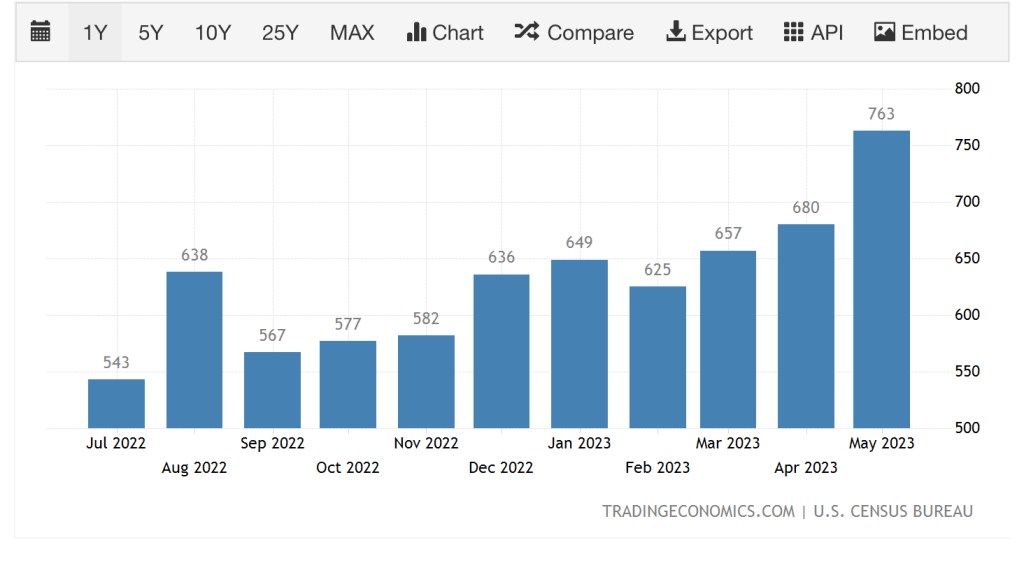

This phenomenon may just ironically hasten the solution to the housing crisis that many have called for: more building. The homebuilding sector, which has been dormant since the Global Financial Crisis, is showing signs of new life. The demand for new homes is red-hot, and the share of newly built homes as a percentage of home sales increased from 15% before the pandemic to 19% now. New home sales have soared 20% over the previous year while existing home sales plummeted 20% over the same period.

Perhaps this stability may be here to stay for quite a while. One might conjecture that if the Fed begins to cut rates, the subsequently lower mortgage rates will entice owners to cash in on their gains by putting up their homes for sale, limiting the increases in home price caused by increasing demand. The more likely route to a decrease in house prices may be a substantial increase in homes built instead of a decrease in demand, as the shortage in housing remains more colossal than ever.

Leave a comment