Last week, markets were boosted by a flurry of good news that hint at a soft landing and strength in the nation’s banking system.

Major indices rose by more than 2% last week as Wall Street investors breathed a sigh of relief as the earnings report of JPMorgan suggested stability in the nation’s banking system. An inflation report showed a continued decline in inflation, suggesting that the Fed’s campaign against inflation is working. The top line inflation rate was 4.0% in last month’s report. Even more encouraging was the fact that core CPI, which proved to be more stubborn over the past year, showed signs of substantial cooling as well-it came in at 4.8% for June compared to 5.3% for May, and is lower than the 5.0% forecast.

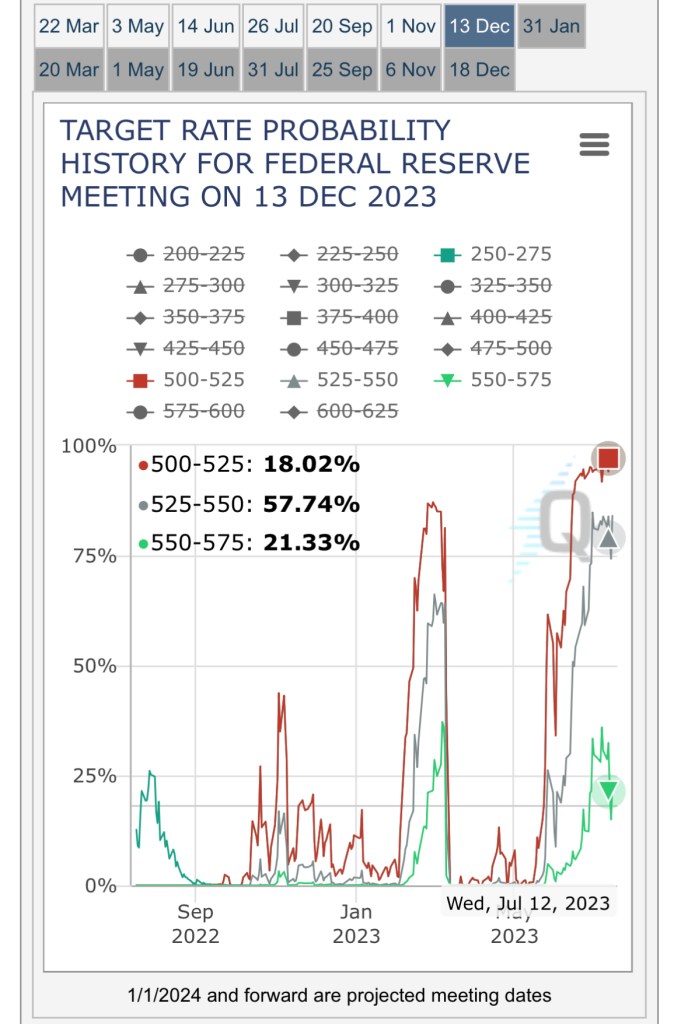

The encouraging news on inflation has quelled projections that the Fed will increase rates two more times. The markets never really expected the that kind of scenario, but in the days after the Fed’s June meeting, expectations rose that the Fed would do so, and it interrupted a solid bill run in the stock market. But with inflation coming in cooler than expected, it appears that markets have shown reluctance in pricing in such a scenario in the past few days.

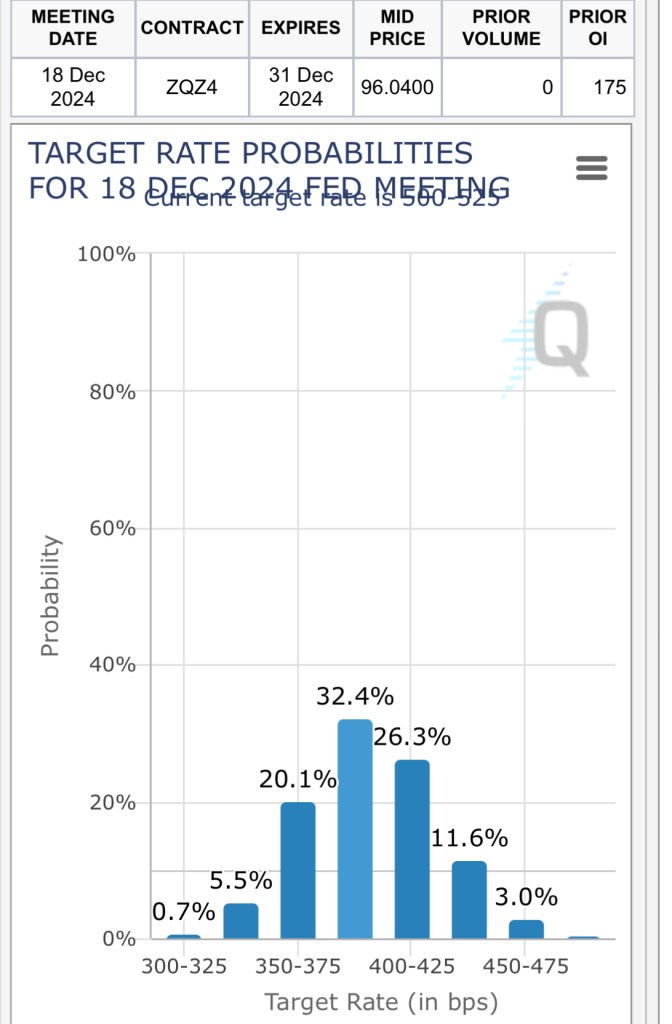

There’s more sources of euphoria for investors now, in terms of Fed policy. When you broaden the time horizon a little, it seems that investors are also pricing in a robust rate-cutting effort by the Fed in 2024. As shown above, the projection for the federal funds rate at the end of this year is at the 5.25%-5.5% range. At the end of next year, though, the federal funds rate is projected to be at 3.75%-4%. This means that markets expect the Fed to cut rates six times throughout the next year after raising them only once this year, an interesting expectation given that the Fed has maintained a hawkish tone even as inflation continues to subside.

It is still very much possible that the Fed might surprise investors this year as the Fed has been clear lately that it intends to increase rates two more times in the second half of the year. But for now, with clear signs that the job market is cooling, there is reason to believe that the Fed may change course sooner or later due to the stronger than expected downward trend in inflation in the past few months.

Earnings data from big banks also bolstered confidence that a soft landing will happen. While the failures of many regional banks, like SVB and First Republic, earlier this year have spurred of a major banking meltdown, the earnings report of JPMorgan has provided early evidence that the banking system remains strong despite these two headline grabbing failings.

This confirms the findings of a stress test more than two weeks ago that suggested that the banking industry would hold up well in a scenario in which a severe recession occurs that causes unemployment to surge to 10%.

It is noteworthy that the banking crisis of March was not the harbinger of doom that many made it out to be; rather, it was a reconsolidation of the banking industry behind much stronger players. SVB, for example, is now owned by First Citizens Bank, a fast-growing bank that has made its name by acquiring distressed banks. First Republic Bank is now owned by JPMorgan, the bank which proved its strength in its most recent earnings report.

Together, these data points paint the picture of a robust and resilient economy, which will receive perhaps a bit of a boost next year as the Fed begins to reduce rates as the fight against inflation winds down. This, along with the tech boom, creates a bullish environment for stocks in the long term as declining interest rates combined with a likely soft landing instills confidence in investors.

Thank you for supporting independent journalism.

Make a monthly donation

Make a yearly donation

Keep it going by chipping in a little.

Any amount would go a long way.

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearly

Leave a comment