The disappointing earnings report from Tesla has triggered a widespread disruption in the tech rally that started this year and accelerated in May with Nvidia’s stellar earnings. The Nasdaq dropped 2.2% in the past two days alone, while the Dow rose modestly, reflecting a broader shift in investment away from tech and into other less risky industries such as healthcare, retail and big banks.

The turmoil in the tech industry, reminiscent of the 2022 tech meltdown, reflects a broad reevaluation of investors’ expectations for their future performance following Tesla’s prediction of reduced production due to factory upgrades. As I said in another piece, when expectations are high as they were pre-Tesla earnings, even minor snippets of negative news may cause mass panic. The current pricing of the stock market suggests a belief among investors that the economy will continue to defy expectations, with lowering inflation enabling the Fed to begin cutting rates even as the economy remains resilient.

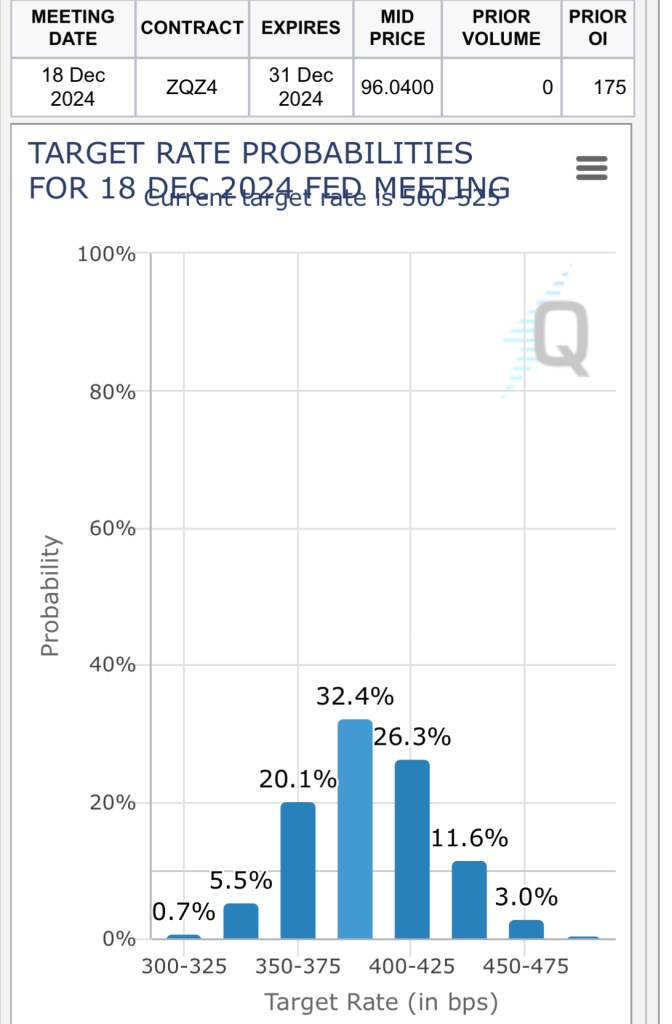

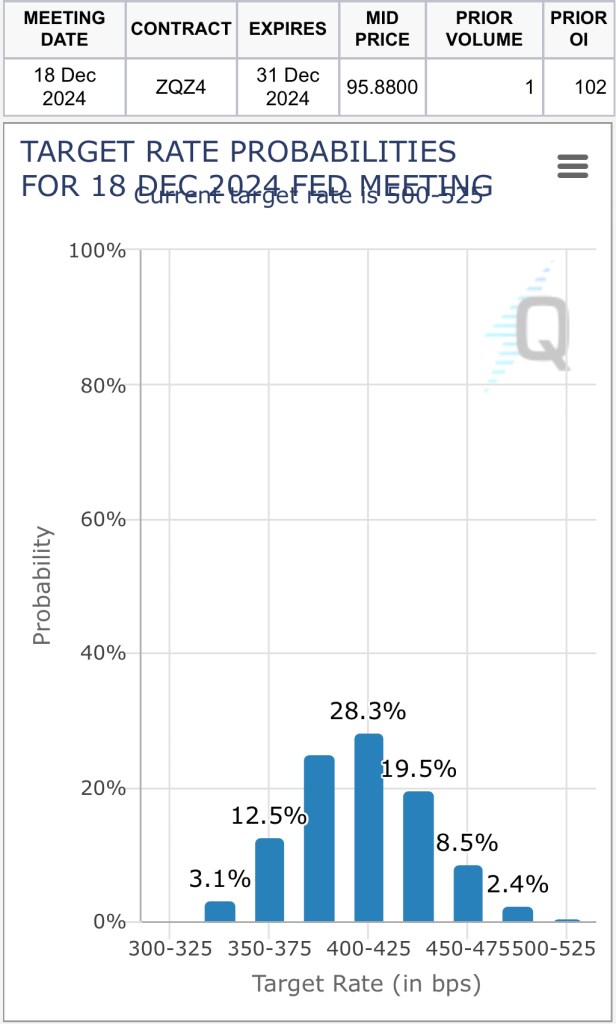

However, it is evident that these expectations for rate cuts has diminished, albeit slightly. (The upper chart shows expectations as of July 14, the lower chart shows expectations as of July 21) This is a likely explanation for why the tech dip over the past few days was as bad as it is: investors aren’t so sure about the rapid rate cutting schedule that was priced in. As shown here, the market is pricing in one less rate hike than what was forecasted just a week ago, and it’s now more likely than not that rates will remain above 4% at the end of 2024. Therefore it’s natural that Tesla, being a tech growth stock, would lose a lot of trust from investors with its third-quarter projections.

Given Tesla’s status as a prominent growth stock, the projections, as expected, had a profound ripple effect. AI was the biggest reason, if not the reason, for the acceleration of the tech rally since May. Therefore as investors reevaluate their expectations for tech, they will most likely be taking a hard look at whether the AI-fueled appreciation in tech stocks over the last two months was well-deserved, which explains the fact that many stock plays more related to AI, like Palantir, C3.AI and Nvidia were harder-hit by the recent selloff than other more well-established tech stocks that have a stronger reputation outside of AI.

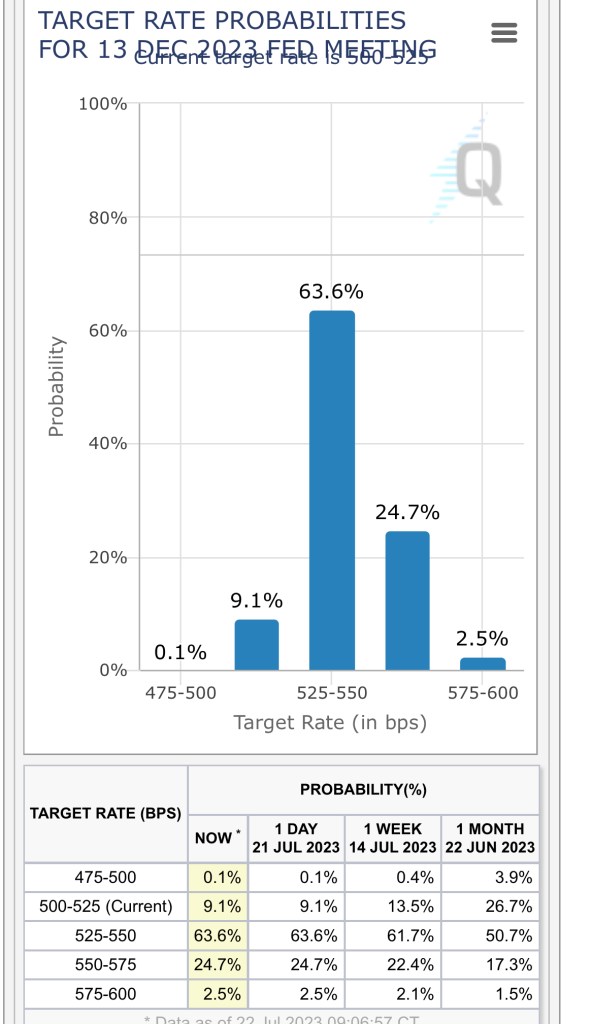

Looking forward, there are many risk factors on the horizon. Despite the Fed being very clear that they will be conducting two more rate hikes this year, the markets do not seem to be taking this possibility very seriously, despite markets pricing in a less expeditious rate-cut schedule in 2024.

The majority belief right now is that the hike at the next Fed meeting, which is next week, will be the last for the year. However, there is no proof right now that the Fed has changed its mind about an additional hike after next week’s meeting, and if the Fed simply reiterates what it has been saying for the past few weeks at the next meeting, it would likely come as a surprise to markets that will send people panicking, even though they should have seen it coming.

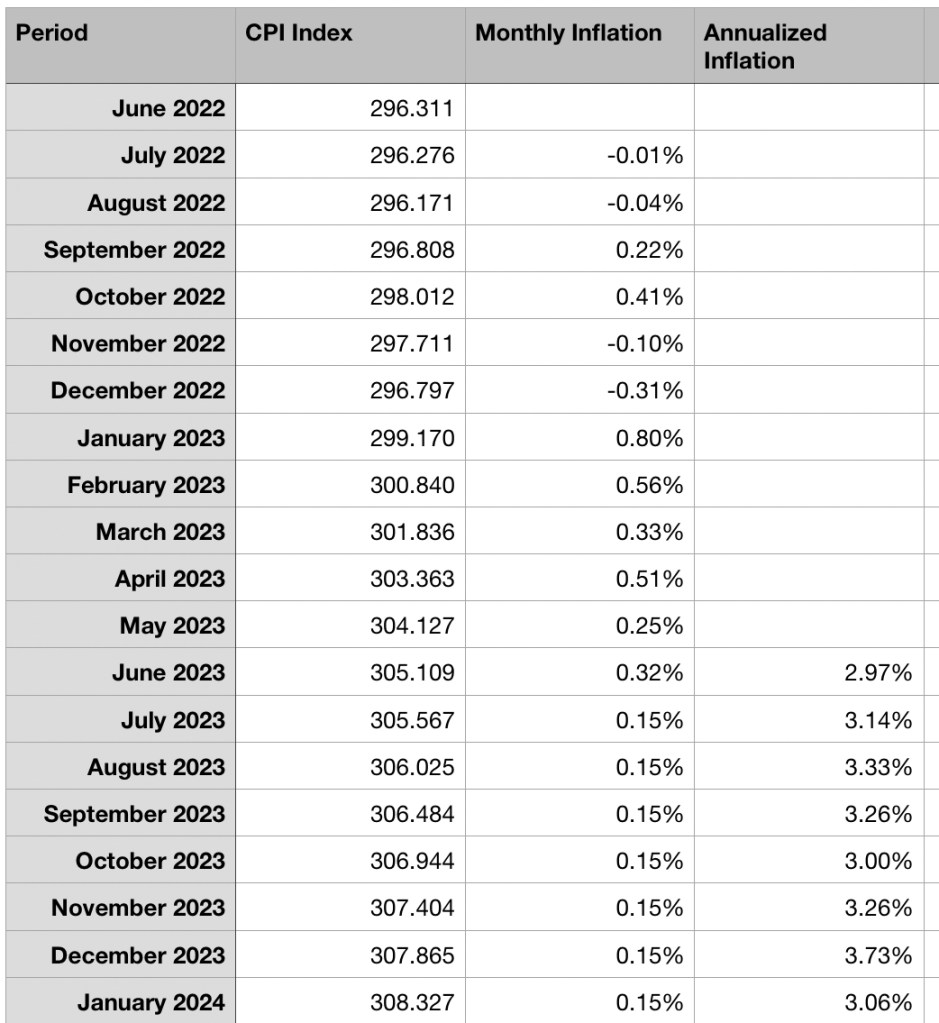

This tendency among analysts to basically ignore the Fed’s statements about the necessity of another hike after July is not entirely baseless, however. Inflation has been cooling faster than expected, and based on how the BLS calculates the top line annualized inflation rate-using the unadjusted CPI from the most recent period and the corresponding period last year, the top line inflation rate for June actually fell below 3%, clocking in at 2.97%.

However, the top line numbers over the past two months showing inflation rapidly declining paints only a part of the picture, and it is possible that the next inflation report will make people uneasy because it is likely to show on paper that inflation has stopped declining. Even if there is no inflation from June to July, the top line number will still show a number of around 3%, because during the corresponding period last year, there was likewise no inflation. Call it the “base effect”: a lower inflation rate during the corresponding period last year will result in a higher inflation rate in the current period. In fact, even if inflation occurs at a 0.15% monthly rate over the next few months (which amounts to a 1.8% annualized inflation rate), the top line inflation data reported by the BLS will remain above 3% for the next few months.

The biggest risk factor here is that the Fed may very well use these data points to argue that inflation remains stubbornly elevated above 2% and therefore additional rate hikes are needed. As I said in a previous column, if interest rates remain at elevated levels for much longer, the impending maturity of trillions of dollars in high-risk debt will potentially lead to a large wave of bankruptcies. This will worsen a potential downturn, likely causing the AI bubble to pop for good.

Leave a comment