Nothing of note happened in this month’s Fed meeting-at least, nothing good of note.

As expected, the Fed rose interest rates by another 25 basis points, to 5.25%-5.5%. The Fed also, once again, hinted at another rate hike after this one. Analysts have said that continued stable economic growth would increase the Fed’s skepticism of the notion that the fight against inflation is over.

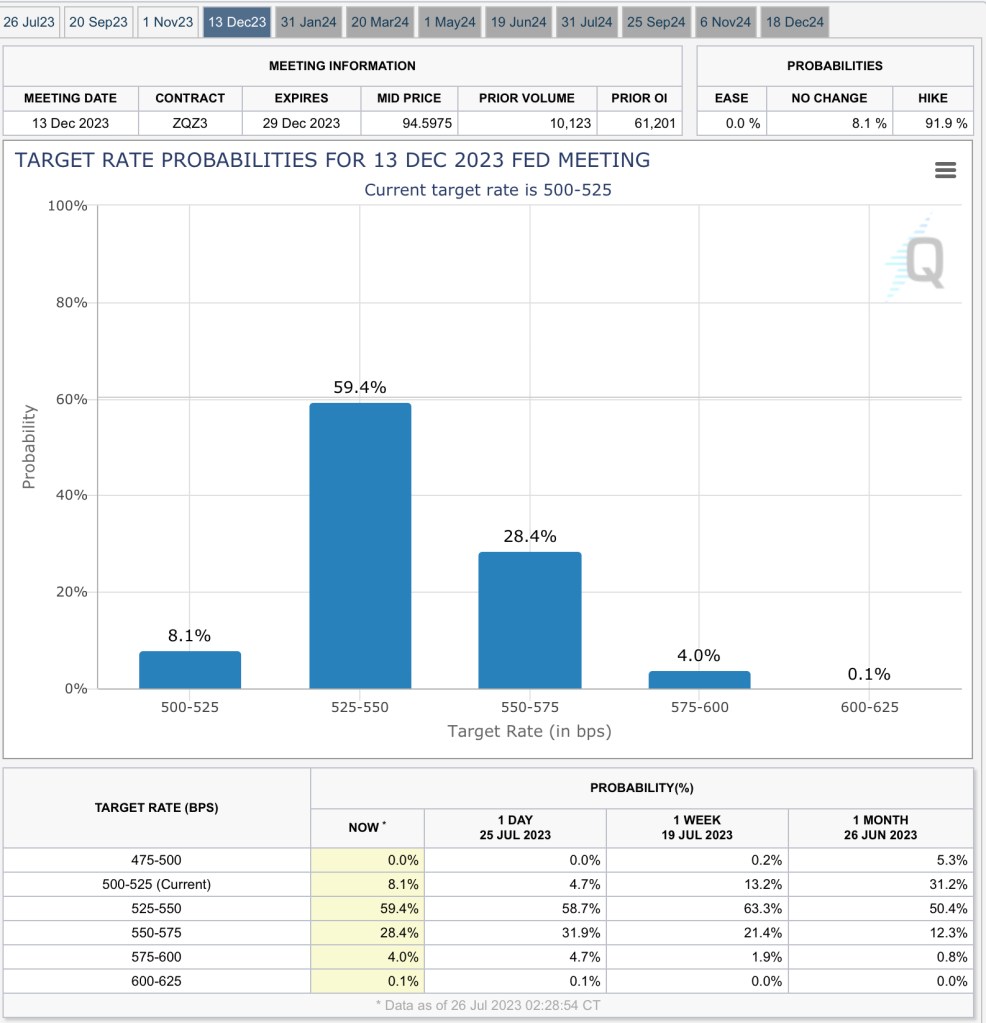

In a previous column, I noted that the markets are not taking the Fed’s comments about there being two more rate hikes in the second half of 2023 seriously. And when the Fed once again reiterated that position today, the reaction from the markets? Crickets. The probability of rates rising further for the remainder of year is pegged by investors at less than one-third.

This reveals that investors at-large have bought so strongly into the idea of a soft landing-an idea backed by rapidly declining top line inflation numbers and an economy that remains solid albeit growing more slowly than before.

However the Fed has maintained its skepticism that inflation has gone down enough to warrant an end to hikes now, with Chairman Jerome Powell reiterating his view that core inflation remains too high for comfort despite the declining top line numbers, and that continued economic growth despite tightening credit conditions may indicate upward inflation pressure.

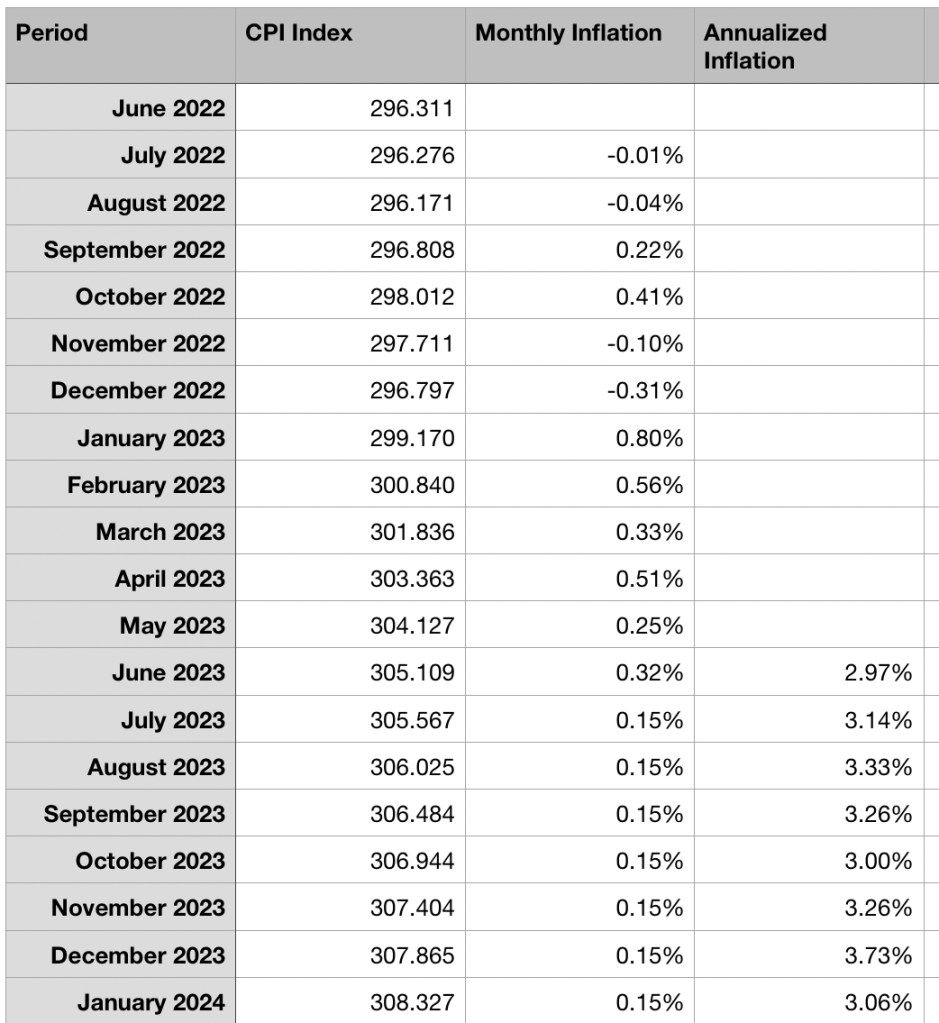

There may yet be more rationale for the Fed to increase rates. Due to how the BLS calculates inflation, even if we assume a low rate of monthly inflation over the next few months, the top line inflation rate will remain above 3% for the foreseeable future. Combined with Powell’s repeated references to “a sustainable drop in inflation”, it is reasonable to expect that the Fed may maintain a hawkish rhetoric throughout the remainder of the year. It is possible that the Fed may consider there to be a “sustainable drop in inflation” to be when the top line number reaches 2% and stays there for a while. In that case, the Fed may maintain a hawkish tone well into 2024.

(Statistics from St. Louis Fed.)

Another major rationale for the Fed to remain hawkish can be found in Powell’s reference to the decreasing odds of a recession, because it implies that the Fed sees the possibility of a recession as less of an impediment to its fulfilling of the employment side of its mandate, and that extending the duration of tight conditions is less likely to have a meaningful negative impact on the economy.

This hawkishness may end up exacerbating the conditions in bond markets as the trillions in outstanding high-yield debt become increasingly hard to finance. The potential of an elevated amount of defaults in 2024 and beyond will increase if market conditions become tighter for longer than markets currently expect. While the possibility of these potential business failures being the catalyst for a recession is uncertain, it nonetheless remains a big risk for equity markets down the road.

The elevated top line inflation rate could also put downward pressure on consumer confidence, as fears about elevated inflation reemerge after months of them dissipating. While many no longer expect a recession, if the Fed operates as if there will not be one it may end up being one of the catalysts that trigger a recession, along with sluggish consumer confidence triggered by a seemingly sticky top line number. The notion among investors that we are out of the woods is a tenuous one.

Leave a comment