As the Fed raises rates and the Treasury resumes auctions after the debt ceiling standoff, 10-year Treasury rates are rising to levels exceeding where they were during the debt ceiling crisis. This has been exasperated by Fitch’s downgrading of the US’s credit rating yesterday from AAA to AA+, and a better-than-expected private sector job forecast by ADP.

What appears to be a sustained high-rate environment presents two pressure points for stock markets. One is economical-the high cost of borrowing signified by these interest rates will weigh on an economy that has defied expectations for quite a while. If the Fed continues to operate as if a recession will not happen, the hawkishness combined with still elevated top line numbers will likely depress consumer spending, and cause a recession.

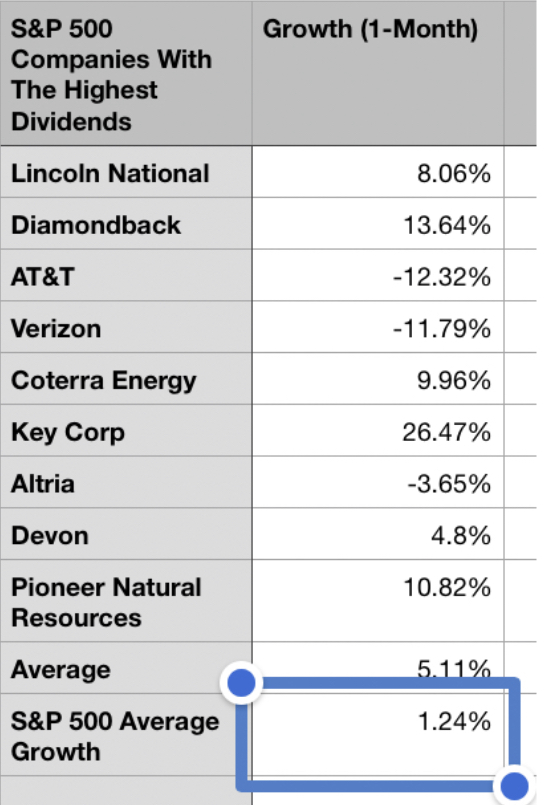

The other is more direct. Growth stocks aside, the average dividend of the S&P 500 is less than 2%, while the 10-year bond yield has grown to above 4%. Nvidia, which arguably accelerated the stock market’s uptrend in May, pays almost no dividend. So if you want to orient your portfolio around earning an income, bonds would appear more appealing than stocks because of their extremely low risk, despite the fact that US debt was downgraded yet again on Wednesday.

The first factor also has an augmenting effect on the second: with such a tight rate environment, the rally in the stock market is by all means unreal, and while investors may be acting like the Fed is done cutting rates now, Chairman Powell indicated at every opportunity he had that he is skeptical of the notion that inflation is slow enough for the Fed to begin pivoting to rate cuts. So why wait for the Fed to smack the markets in the head with the reality of what it has intended to do all along, and watch as you lose a large chunk of your money?

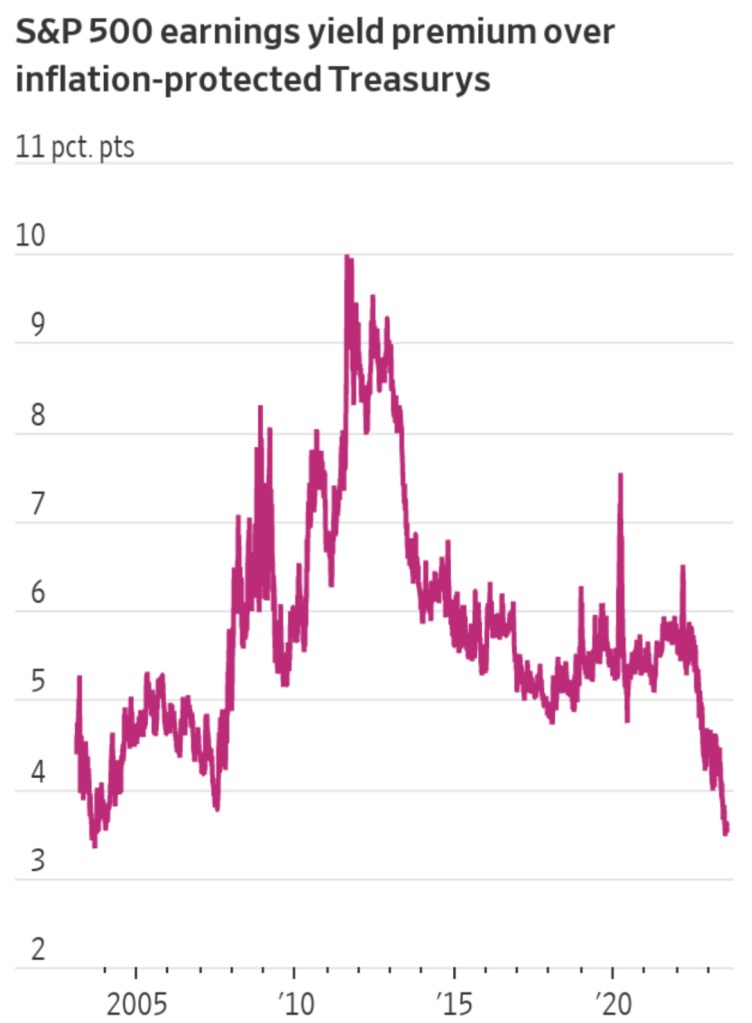

Above is a graph showing the premium of the earnings yield of the S&P 500 over inflation-protected Treasurys. It has fallen over the recent years as bond rates and stock prices rose. The consensus now is that this premium won’t stay low forever-either stock prices fall or bond yields fall, and investors are expecting the latter to happen first. But with the Fed’s stubbornness and perhaps emboldenment by the resilient economy, yields may hold up for quite a while.

The only stocks that are worth holding right now are ones that are offering high yields-and investors are realizing it. Currently, the highest-yielding stocks in the S&P 500 have grown much faster than the S&P 500 in the previous month, when fears about bond yields among investors have really began to emerge.

Leave a comment