Fitch finally did what it had been threatening for months since the debt ceiling standoff: it downgraded the sovereign credit rating of the United States on Thursday. This is the second search downgrade since the turn of the century as polarization in the United States reaches a new high and as spending continues to rise unabated.

The drop in the stock market that ensued marked a sharp break from the euphoric run of the past two months, but was mild compared to what happened 12 years ago when S&P first downgraded the credit rating of the United States after a debt ceiling standoff. The major indices dropped by more than 5% that day, while on Thursday, the index that dropped the most was the Nasdaq, and it only dropped 2%. This indicates a degree of indifference to the recent downgrade compared to the downgrade in 2011. This can be explained by the fact that the market is being fueled by a tech-induced euphoria and the recession predictions from earlier being replaced by forecasts of a “soft landing”.

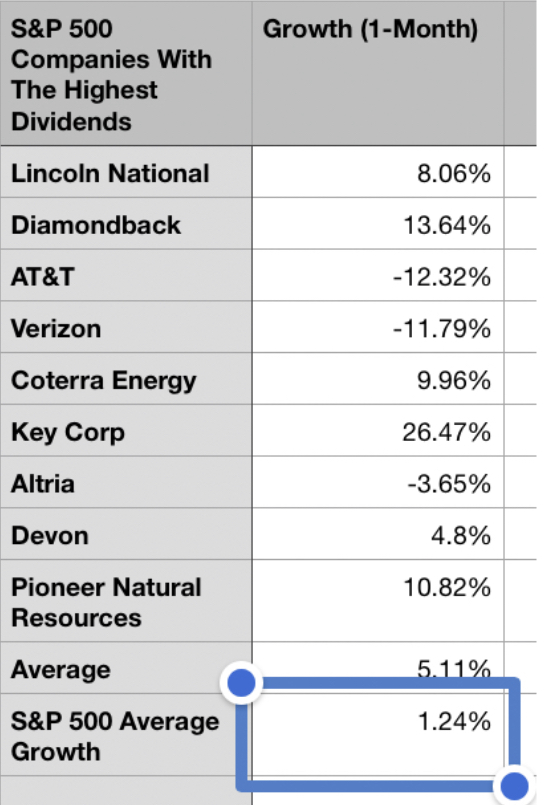

The downgrade, however, poses a risk to stocks with low dividends, which make up a lot of growth stocks as Treasury rates increase. Though Treasury rates have declined after a cooler than expected job report, they remain at some of the highest points within the past five years. Already, investors are flocking from low-dividend stocks to higher-dividend stocks as yields remain high with some fearing that they may remain higher for longer with the Fed’s continued hawkishness.

(The growth of the nine S&P 500 companies that pay the highest dividends vs. the rest of the index over the past month)

This has especially important implications for more AI-dependent plays-many of the biggest ones have little or no dividend. Nvidia only offers a 0.04% dividend, while Palantir has none, and neither does Advanced Micro Devices. A sustained high rate environment will lead to some thinking about risk and reward as the tech rally continues. After all, if all the future growth is priced in for these stocks, which some people believe has already happened, there is no reason to keep holding these stocks.

In the coming week, the BLS will release its monthly inflation report. Analysts currently expect an inflation rate of 3.3%. Because of how the BLS calculates inflation, this might not be a very bad reading, but it may have a negative effect on consumer confidence since a look at the top line numbers might produce the conclusion that inflation has stopped dropping and is on the rise again.

Given Chair Powell’s remarks about the need for a sustainable drop in inflation to the 2% level, it is possible that even with a low rate of monthly inflation, the Fed might end up not pivoting until well into 2024. And with a job market that clearly is cooling according to the past two job reports, it is not unreasonable to assume that the economy could run headlong into a recession amid a job market that may not be holding up as well against raising interest rates as many have said.

Leave a comment