The past few months already felt surreal with the economy defying dire projections of economic calamity earlier in the year that were made much more tangible with the March-April bank failures.

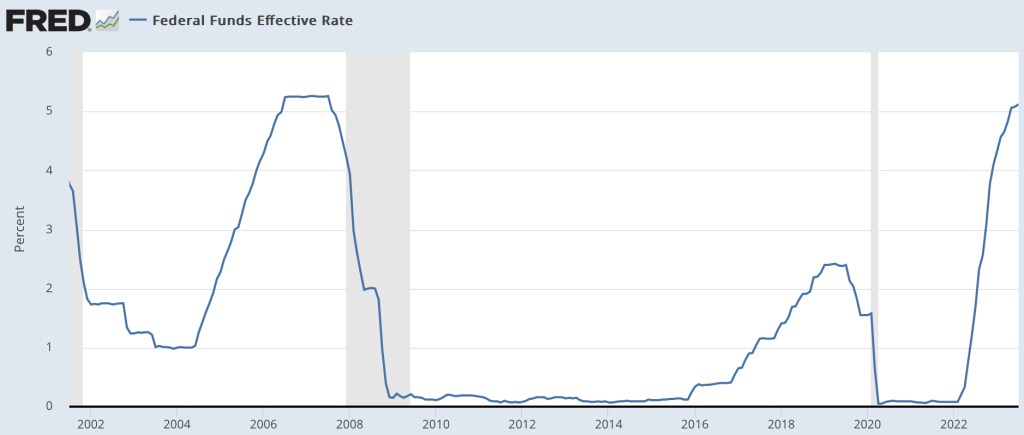

The Atlanta Fed’s NowCast takes that to a whole another level. It’s most recent NowCast puts Q3 GDP at 5.8%-which if true, means the best quarter of growth since Q4 2021, during the early years of the post-pandemic recovery. And judging by recent history, the Atlanta Fed is relatively reliable-at least it won’t be seriously off. Even If this current estimate turns out to be an overestimate by the historical average margin of error (0.82%), it still would mean that while the rest of the developed world-the rest of the entire world, even-struggle with inflation and slow growth, the US, by dealing with it head on-it raised rates much faster than Europe did-not only resolved the inflation crisis earlier than the rest of the developed world but achieved rapid economic growth despite much tighter conditions.

This is supposed to be cause for celebration-if you don’t think about the looming commercial real estate debt crisis, a potential crisis in the high yields market and the fact that banks controlling assets equivalent to more than 10% of the US economy have been given a warning by Moody’s.

Moreover, even though inflation has mostly subsided, the Fed still sees upside inflation risk-from continuing supply chain problems and rise in aggregate demand. Additionally, the Fed remains unwavering in its belief that “a period of below-trend growth in real GDP and some softening in labor market conditions as needed to bring aggregate supply and aggregate demand into better balance and reduce inflation pressures sufficiently to return inflation to 2 percent over time.”

Simply put, the Fed’s belief is that inflation cannot truly return to normal in a sustained fashion until a recession happens-and with Chairman Powell’s repeated insistence on the need for a sustained return to 2% and the insistence that we are not there yet, it seems like the Fed is prepared to use whatever means necessary to crush all the risk factors possible that might lead to inflationary pressures, even when the markets may think that the Fed is overplaying its hand. So it is likely that the strong economy might just be another inflationary risk factor for the Fed to crush.

This is supposed to be a time where the Fed should be worried about whether it is overplaying its hand. With higher interest rates and the rise of remote work, the commercial real estate (CRE) industry is in a dire crisis, along with the banks that loan to them. Some 30% of banks hold CRE loans exceeding 300% of capital or construction and development banks exceeding 100% of capital. Additionally, community banks hold 28% ($865 billion) of all real estate loans, an outsized proportion compared to its 15% share of all loans.

Some believe that a full-on GFC style financial collapse is unlikely, given that CRE loans are not as large of a share of bank assets that residential mortgages were before the GFC. Currently, commercial real estate loans make up 10% of all bank assets-residential real estate loans made up 20% of bank assets before the GFC. 2008 was a near total collapse of the entire financial system, and being halfway there isn’t that reassuring, with the risks to equity especially apparent given the years-long bull run in equities, especially tech-related equities that have been propped up by historically low interest rates, and the hawkishness of the Fed now compared to the last time interest rates were at similar levels, which was in 2007. In other words, the Fed feels a need to crush the current economy’s growth to stem inflation, but this will end up crushing the banking industry (at least regional banking) and equity markets with it.

While this ultimately might not end up being worse than the GFC, it is impossible to ignore the gap between what investors perceive now (a literally invincible economy) and the reality that has yet to set in-and that should be the scariest part about today’s financial markets.

Leave a comment