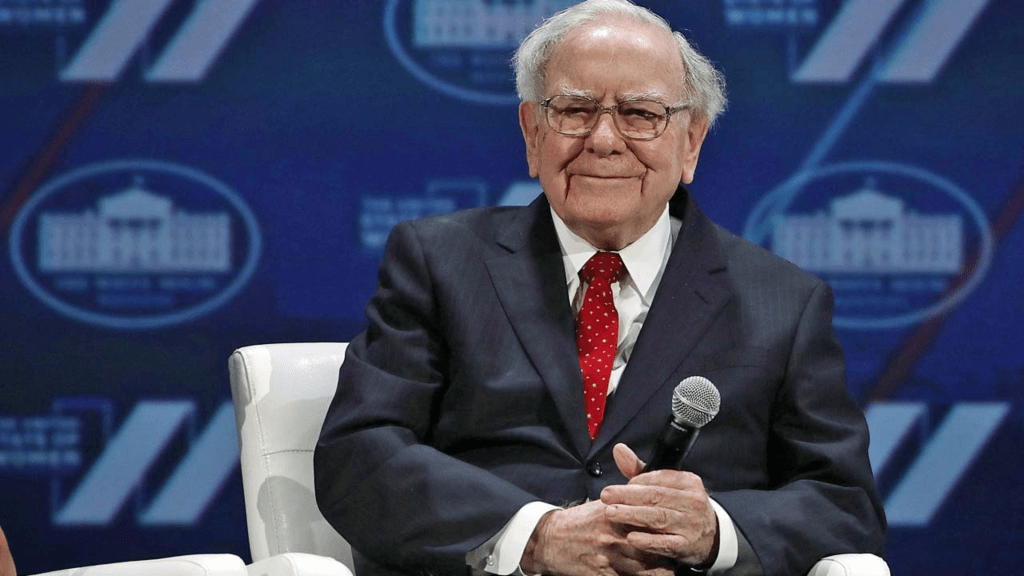

Warren Buffett has made waves recently by selling $8 billion worth of stock in the second quarter. In Berkshire Hathaway’s most recent filing, the investment company sold $13 billion in stock and bought less than $5 billion. This is on top of a $13 billion stock sale that occurred in the first quarter, an indication of the stock mogul’s wavering faith in the markets.

Historically, Mr. Buffett has been a cheerleader for American stocks, and his big sales over the first half of the year has made considerable waves across the financial world. Many analysts have interpreted this sale as a sign of trouble for American equities. “Buffett has always acted as a voice of confidence for markets during turbulent times.” said David Nicholas, president and founder of Nicholas Wealth Management, for Newsweek. “But this marks a significant departure in his time and positioning towards US equities.”

Other analysts have noted some evidence for Mr. Buffett’s apparent belief that the economy might be headed for trouble. Steve Hanke, a professor of applied economics at Johns Hopkins University who served in the Reagan administration, pointed to a contraction in money supply caused by the Fed’s increase in interest rates. “The money supply is fuel for the economy, and it’s been contracting over the last year.” he said. He notes that money supply has been contracting at a rate not seen since the 30s, and that every major contraction in money supply until now has been accompanied by an economic downturn.

Mr. Hanke also commented that “the economy has been running on fumes”. These fumes are most likely the result of pandemic savings that Americans have been relying on since the end of the pandemic. While it is true that the recent trend of positive real wage growth might give American consumers a little more latitude for them to spend, the fact remains that the drainage of excess pandemic savings contributes to the economy at a rate of $1 trillion per year. In other words, spending from excess pandemic savings is the only thing keeping the US out of a recession, and the exhaustion of these savings would cause a crunch in demand unless consumers take on more debt or stretch their baseline savings even further. The effects of pandemic savings depletion are beginning to show, with credit card debt recently exceeding $1 trillion and late payments and defaults on credit card and auto-loan debt steadily rising. “The increase in delinquencies and defaults is symptomatic of the tough decisions that these households are having to make right now — whether to pay their credit card bills, their rent or buy groceries,” Mark Zandi, chief economist at Moody’s, said for the Washington Post.

These issues are likely to get worse as interest rates are set to remain higher for longer, buoyed by unexpectedly strong consumer activity, as measured by non-manufacturing PMI. The most recent non-manufacturing PMI report shows that the index strengthened to a 6-month high, standing at 54.5 for the month, indicating strong consumer activity expansion. Increasingly markets are pricing in an additional rate hike for this year.

This contradicts previous readings of declining consumer confidence and signifies continued stickiness in consumer prices. This also suggests that instead of cutting back on spending as excess savings dwindle, consumers are instead choosing to take on more debt, particularly on their credit cards. While this may produce a short boost to the economy, these positive effects will fade as default rates rise further.

The continuing unease surrounding interest rates has already taken a toll on stock markets, and has added to other worries surrounding the tech industry. The Nasdaq has fallen more than 2% over the past week, with the rout reflecting not only interest rate concerns in the US but also US-China tensions, with China reportedly banning iPhones for use by government officials. Stocks related to AI have fallen significantly as well, with the foremost AI stock Nvidia falling 7.7% over the past week.

It is clear now that the many factors that created the summer equities boom-optimism about inflation, and enthusiasm for AI-no longer exist. Continuing strength in consumer markets is complicating hopes for a steady path to 2% inflation, and the greed that defined most analyst sentiments over the summer simply went away-the CNN Fear and Greed index dropped from as high as 80 to only the 50s today.

Leave a comment