Before Nvidia’s earnings report, there was a widespread fear on Wall Street that, given the ascendant AI company’s already-long winning streak, more than doubling in value for summer of 2023 to now, there had to be some sort of reckoning with the fact that its the substance that Nvidia delivers would likely not live up to the hype it has generated thus far. Most were preparing for a correction in the stock market once Nvidia’s report came out-in fact, many were assuming it to be a foregone conclusion and were bracing for it, as shown by a selloff that led Nvidia to drop more than 7% in the two days leading up to last Wednesday.

But, surprisingly, none of these fears came to fruition. Nvidia once again blew past expectations, beating earnings estimates by 56 cents per share, $5.16 per share compared to a forecast of $4.60 per share-a 12.2% beat. Nvidia also beat revenue estimates, reporting a revenue of $22.1 billion compared to forecasts of $20.4 billion. Nvidia also posted an upbeat guidance for the first quarter of 2024-$24 billion compared to a forecast of $21.9 billion. To give a perspective of just how much Nvidia has grown in the recent years, its revenue for all of 2022 was just under $27 billion, and its revenue for all of 2023 was just shy of $61 billion. Its annual profit has grown from $4.386 billion in 2022 to $29.76 billion in 2023-a 678% increase.

This explosive growth has swept away residual fears about the overvaluation of Nvidia, which used to be expressed much more openly in the summer of 2023. As the rapid growth that was needed to sustain such growth in share price has ultimately came to fruition, few, if any, are arguing now that Nvidia faces the problems of overvaluation that critics once frequently highlighted.

If Nvidia maintains its explosive growth as forecasted for this year, it will have a P/E ratio of less than 40-still high but not as overwhelmingly higher than other Magnificent 7 companies, at its current price. So the recent appreciation of Nvidia remains within the realm of reasonability, in my opinion, but it borders on bubble territory. As someone who was skeptical of Nvidia’s valuations since mid-2023, Nvidia has proven its worth to some extent, but it still has a long way to go to fully justify its current valuation.

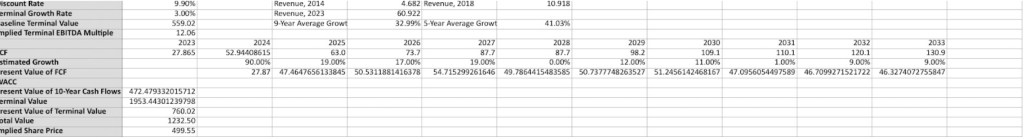

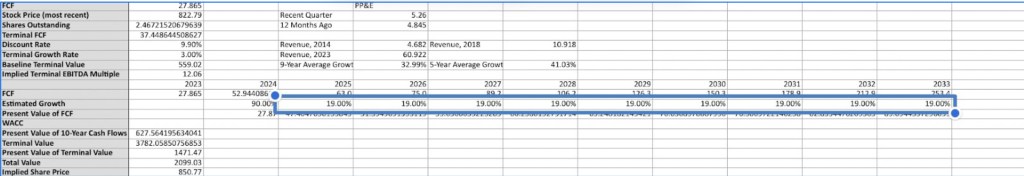

Many current estimates are nowhere near as optimistic about the future of Nvidia as investors are right now. The estimated share price according to estimates from Seeking Alpha imply a $500 share price-a nearly 40% downside.

However, a closer examination of the data shows that very few people have looked that far into the future when it comes to Nvidia’s growth. Estimates for Nvidia’s growth in 2027 and beyond are few and far between. So I took the liberty to find out exactly what kind of growth that the market is pricing in, and I found this:

Beyond 2024, a 19% average growth rate for 9 years!

That is assuming a terminal growth rate that is much higher than 2%, the estimated future growth rate of the US economy. Though it is nowhere nearly as insane as what bears have said in mid-2023, it still is a steep bar for any company to climb-but it is a plausible figure if you among the optimists regarding AI-the overwhelming majority of investors on Wall Street right now.

However, if your time horizon is relatively short-if you’re planning on holding for 2 or 3 years-then it might not be as good of an option for you as uncertainty over rate cuts given stubborn inflation may might blunt some of the stock’s strength, not to mention the economy potentially slowing down significantly later in the year. But if you are planning to hold way into the future, this is the stock for you if you believe in the prospect of AI and NVIDIA’s continued domination in the field.

Leave a comment