The technology sector has experienced significant volatility in recent days, echoing past market corrections and raising concerns among investors worldwide. As the world stares down yet another financial storm, let’s take a look at how we got here.

The Trigger

On July 24th, the tech-heavy Nasdaq index suffered its third-largest point drop in history, triggered by Tesla’s disappointing earnings report. Over the two most recent trading sessions, the Nasdaq fell approximately 800 points, with industry leader Nvidia leading the decline. A brief recovery following Microsoft’s positive earnings report was quickly overshadowed by an unexpected U.S. jobs report, which showed rising unemployment and slower job growth than anticipated.

Global Meltdown

The ripple effects of this downturn were felt globally, particularly in Japan, where the Nikkei 225 experienced a substantial decline of nearly 7,000 points over five trading days. This sharp drop has raised concerns about potential overvaluation in the Japanese market, especially given the country’s prolonged economic challenges and relative lack of tech giants comparable to U.S. counterparts.

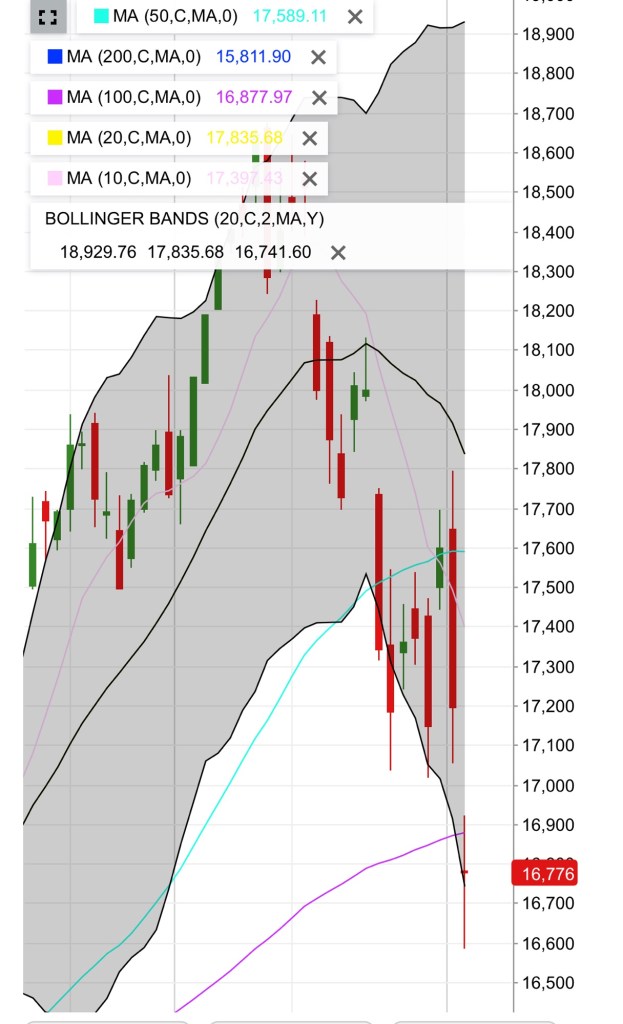

According to technical analysis of Nasdaq’s recent performance, the index has fallen below crucial support levels, including the 20-day and 100-day moving averages. This breach has pushed the tech sector firmly into correction territory, which should prompt investors to reassess their positions and market outlook.

What Is The Fed Doing?

The market turbulence comes at a time of uncertainty regarding U.S. monetary policy. The Federal Reserve has delayed potential interest rate cuts until at least September, leaving analysts debating whether the Fed’s approach has been too aggressive or not responsive enough to evolving economic indicators.

June marked a significant milestone in the fight against inflation, with the first recorded price decline since the pandemic began. This development suggests that the Fed’s high-interest rate policy may be having its intended effect, albeit with a lag. However, the most recent jobs report indicates that these high rates might now be impacting the economy more significantly than previously thought.

Looking Ahead

As we grapple with these developments, several key events and data points will be crucial for us to make key decisions:

- Upcoming earnings reports from major tech companies, particularly Nvidia and Apple, will provide insight into the sector’s health and future prospects.

- The next U.S. jobs report, due before the Fed’s September meeting, will be pivotal in determining the direction of monetary policy.

- Global market reactions, especially in major economies like Japan, could influence investor behavior and potentially lead to further volatility.

Time to Be Safe

Given the current market conditions, investors may want to reassess their portfolios and strongly consider more defensive positions. While the tech sector has been a strong performer in recent years, recent valuations (especially with Nvidia almost tripling YTD at some points this year!) raises valid concerns that we may be in a bubble which is coming close to bursting, since all the touting on earnings calls about true impact of AI on our productivity as a society has yet to materialize and will likely take years to come to fruition, if it is indeed as game-changing as people think.

Market corrections are a normal part of economic cycles. However, how long an economic cycle lasts will vary, and like in 1929 and 2008, few people would have seen them coming until they hit. The wave in the distance appears to be getting taller for now, and only time will tell, along with policy and what happens next in our volatile world, whether this is just a brief correction or the beginning of a more devastating downturn that could impact the market for many years.

Currently, as a general piece of advice, the tech market right now is no longer for the faint-hearted. As mentioned, the true impact of artificial intelligence on our productivity as a society will take many years to come to fruition. But if you believe that AI will truly be as transformative as the past year of hype suggests, then what comes ahead will probably be a loss that you can stomach, and future downturns will even pose ample buying opportunities. Patience is key. As history has shown in the aftermath of 2008, those with enough patience will stand to gain immensely in the long term.

Leave a comment